3 High Quality Dividend Growth Stocks

In this article I’ll be sharing 3 dividend stocks that have been growing their dividend while still gaining massive capital appreciation. These companies have all grown their net income incredibly quickly over the past 10 years to be able to continue growing their dividends.

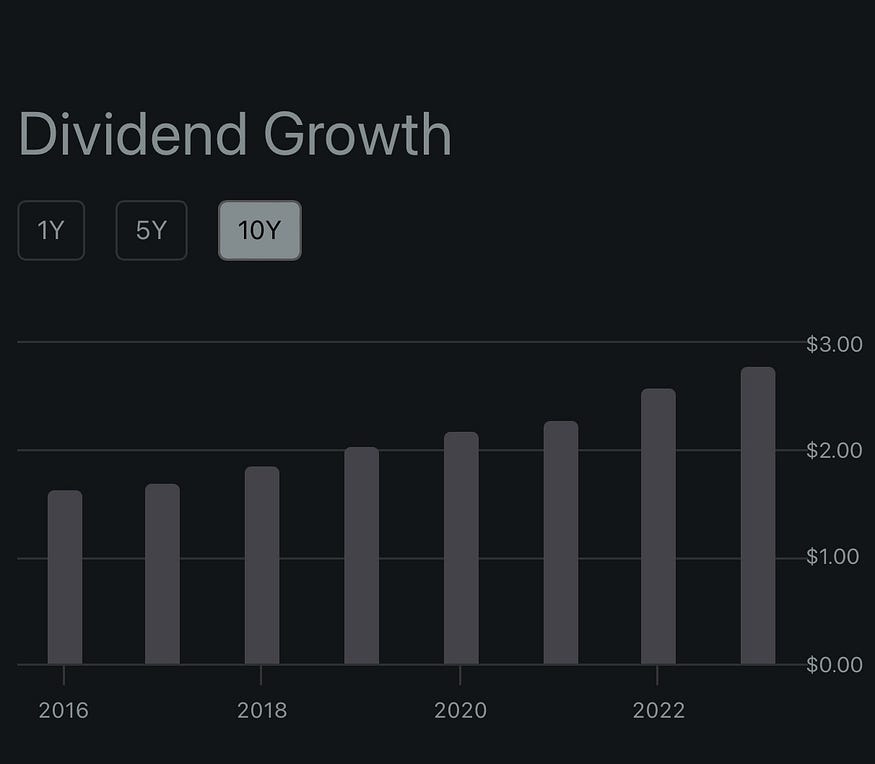

1- Waste Management ($WM)

Waste Management has been paying a dividend for the past 21 consecutive years. They paid 1.50$ per share in dividends in 2014 and have grown it to 2.80$ in 2023. This equals to a 7.18% dividend CAGR (compound annual growth rate). While averaging 7% dividend growth is great it’s actually the lowest CAGR on this list!

In 2014 Waste management’s net income was $1.3 billion and in 2023 it grew to $2.3 billion. Their net income almost doubled in this nine year period. They currently have a 46.64% payout ratio so they do have some room to keep on growing it but it may slow down if they invest more heavily into growing the business.

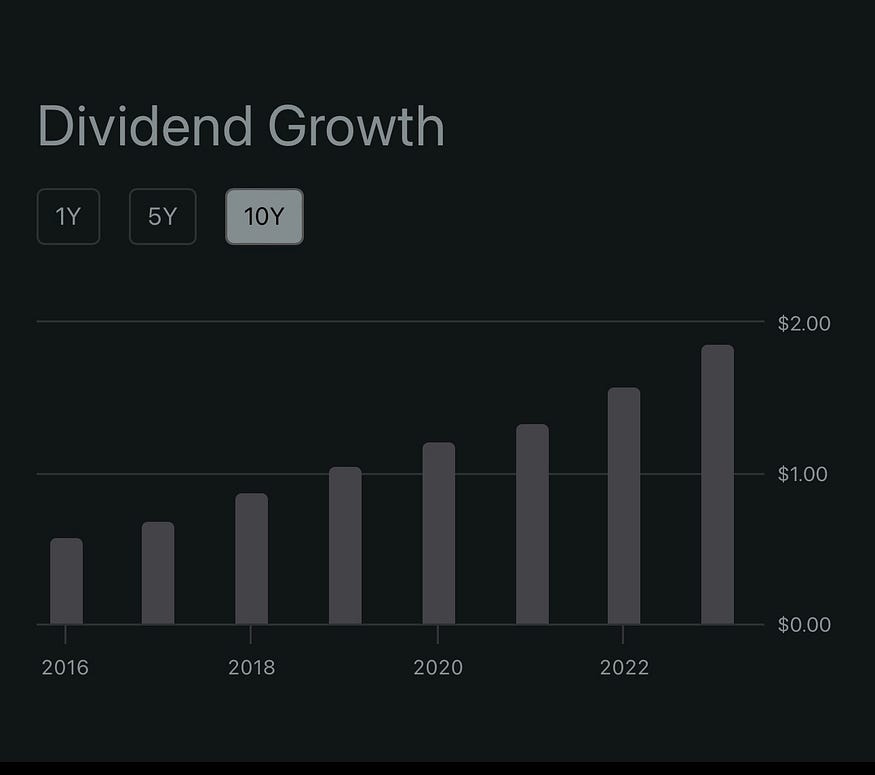

2- Visa ($V)

Visa a payment network company has been paying a dividend for the past 14 years and has been growing their dividend at a really fast pace while also growing their profits just as fast. They’ve grown their dividends per share from $0.42 in 2014 all the way to $1.87 in 2023. This is an astounding 18.05% dividend compound annual growth rate.

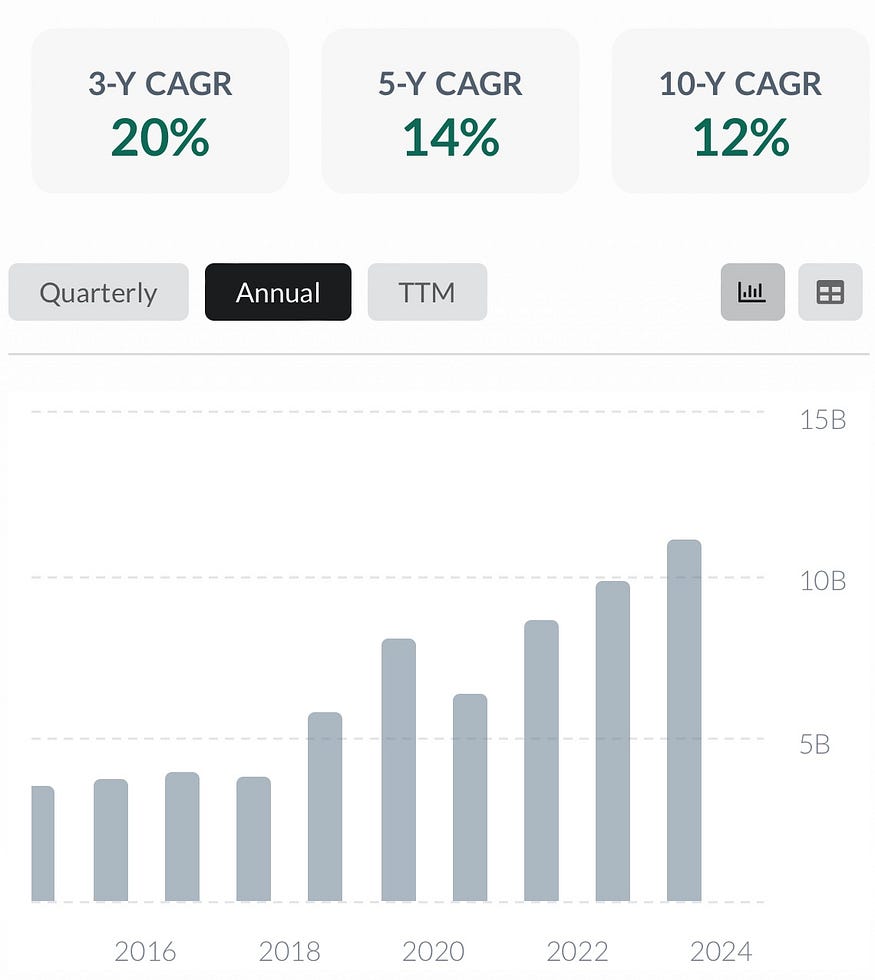

Their net income has also grown at an incredible pace. Visa’s net income in 2014 was $5.60 billion, and in 2023 it was $17.98 billion. This represents a massive increase in income over the past nine years.

Visa also currently has a 21% payout ratio which means they can easily keep on growing their dividend.

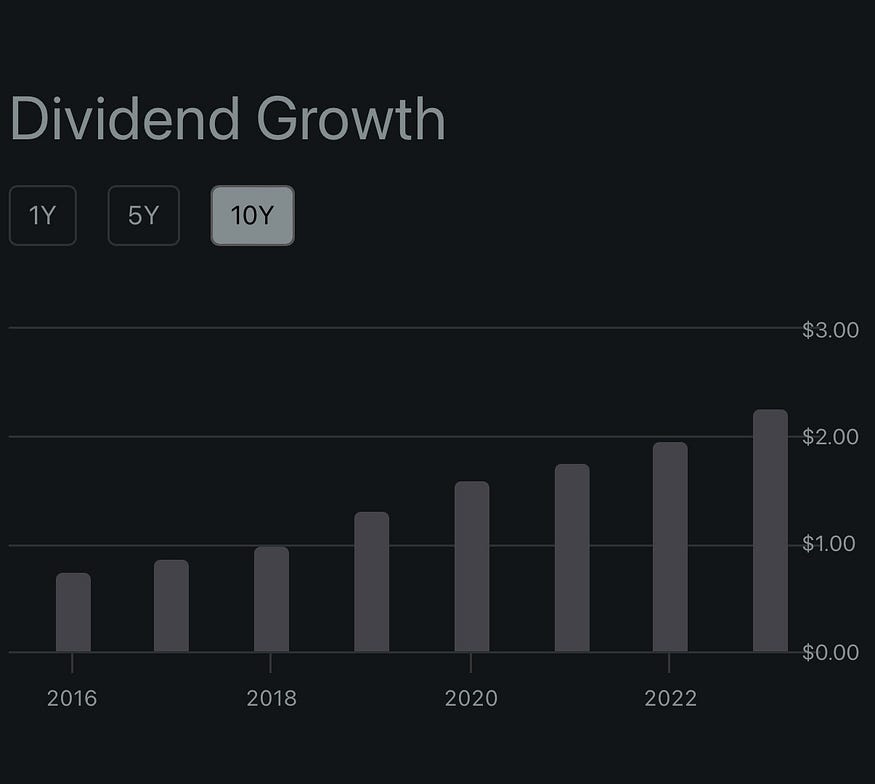

3- Mastercard ($MA)

Mastercard another payment network company has been paying a dividend for 13 years and has grown their dividend from $.44 in 2014 to $2.28 in 2023 which is a slightly lower growth rate than Visa as its dividend growth CAGR is 17.88%

Mastercard’s net income in 2014 was $3.617 billion, and in 2023 it was $11.195 billion. This is a significant increase of over 200% growth over a nine-year period.

Mastercard’s net income growth combined with a 19.55% dividend payout should mean for even more continued growth in their dividends.

Disclaimer: Nothing on this blog is intended as financial or investing advice. Please do your own due diligence.

Comments

Post a Comment