Starbucks Plunges 17% after Q2 Earnings Miss

Starbucks released their second quarter earnings yesterday and they do not look pretty. Starbucks missed on revenue, earnings, and same store growth while also lowering their full year guidance.

So what happened?

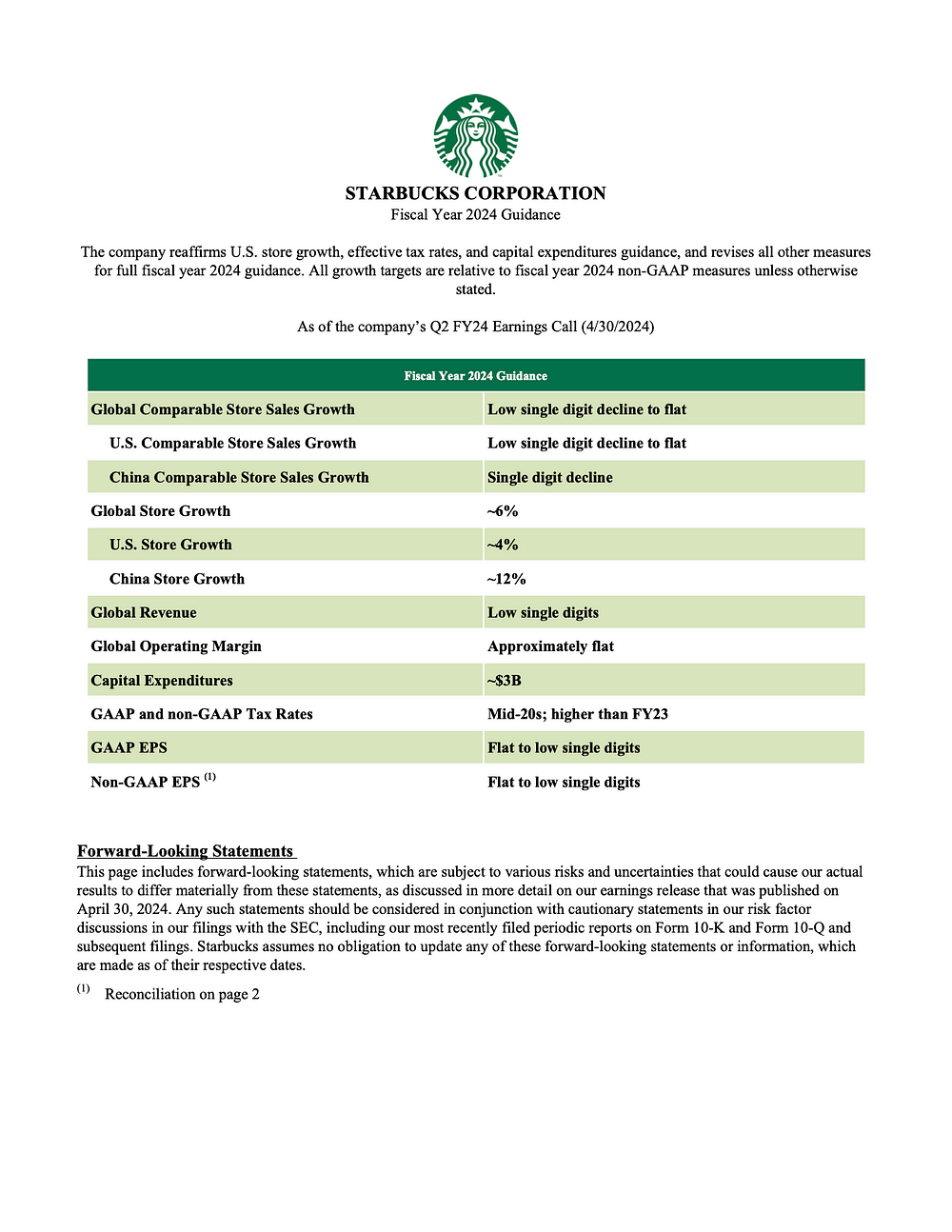

Revenue for the second quarter dropped 2% year over year to $8.6 billion and adjusted EPS also came in lower, down 8% to $0.68. Starbucks now expects 2024 revenue growth of low-single digits, down from the previous range of 7% to 10%, which itself was down from a prior guidance of 10% to 12%. This is a terrible look for the company as they have to keep on lowering their guidance.

Starbucks has been adding new promotions to their app to try and attract more customers but active members have declined to 32.8 million, compared to 34.3 million last quarter. The CEO said a future area of improvement is their wait times as a lot of customers didn’t complete their orders because of long wait times.

The biggest problem Starbucks faced in Q2 was China. The Starbucks in China saw same store sales down 11%, foot traffic down 8%, and the average ticket size down 4%. Starbucks has been investing a lot of time and money to grow in China and expect quite a lot of growth. They’ve now lowered their guidance for 2024 massively.

They expected as of Q4 2023 that China comparable store sales growth to grow 4%–6% and China store growth of 13%. They now expect China same store sales to decline low single digits or stay flat and store growth of 12%

Here’s what Starbucks reported, compared to Wall Street estimates, per Bloomberg consensus estimates:

- Adjusted earnings per share: $0.68 versus $0.80

- Revenue: $8.56 billion versus $9.13 billion

- Same-store sales growth: -4% versus 1.46%

- North America: -3% versus 2.05%

- US: -3% versus 2.31%

- International: -6% versus 1.36%

- China: -11% versus -1.62%

- Foot traffic growth: -6% versus -0.27%

- North America: -7%, compared to up 6% in Q2 2023

- International: -3%, compared to up 7% in Q2 2023

- Ticket size growth: 2% versus 2.41%

- North America: 4%, compared to up 5% in Q2 2023

- International: -3%, compared to flat in Q2 202

Comments

Post a Comment