Why Dividend Investors Love Realty Income ($O)

Realty Income may be the most popular dividend stock on the internet. Realty Income is a REIT which specializes in triple net leases in single tenant commercial properties it currently has a 5.72% dividend yield. In this article I’ll share 3 reasons why dividend investors love this dividend stock.

As you can see in the picture Realty Income calls themselves “The Monthly Dividend Company” and they are known as just that. Realty Income has paid 646 consecutive monthly dividends! Dividend investors like monthly dividends more than quarterly dividends because they can compound faster which is amazing. Investors also like monthly dividends because they get paid more often.

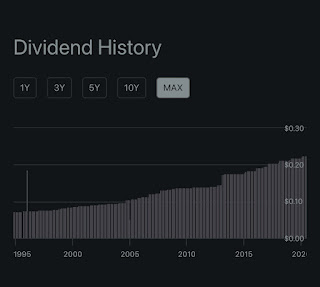

2 - Dividend Growth

Realty Income is a dividend aristocrat which means they’ve raised their dividends every year for at least the past 25 years. Since Reality Income went public in 1994, they have raised the dividend a staggering 124 times. They’ve grown the dividend a lot in just the past five years. In 2019 the dividend was $2.63 and in 2023 it was $3.06 which is a 3.6% CAGR. Realty Income currently has a 5.72% dividend yield

3 - Track Record

Realty Income has an incredible track record of share price growth and dividend growth but what’s more important is their occupancy numbers and their tenants. Some of the biggest companies in the world are their tenants including Walmart, Lowe’s, and FedEx.

While they have some high quality tenants they are also quite diversified with different sectors.

Realty Income has an incredible occupancy rate, as of December 31, 2023, Realty Income’s portfolio occupancy rate was 98.6%. Their occupancy rate has not fallen below 96% in the past 30 years!

Overall Realty Income has had an incredible track record of share growth and dividend growth since their IPO in 1994.

Price Appreciation?? - Value of the O Stock, in my account, has lost over 15% and paid dividends do not even cover. I see no real plans to recover

ReplyDeleteIf you look at Realty Incomes full stock chart dating back to when they IPO'd they've had incredible stock price appreciation. With that being said the past few years have been quite rough on them. Why don't you see any room to recover? The main reason they're down is because of interest rates. Their business hasn't gotten worse and even though the share price has depreciated they've been growing their earnings and recently made a massive acquisition.

Delete