Why Dividend Investors Love SCHD

Why Dividend Investors Love SCHD

The Schwab U.S. Dividend Equity ETF (SCHD) has become a favorite among dividend investors, and for good reason. This ETF offers a great combination of features that specifically cater to a dividend investor’s strategy. In this article, we’ll explore three specific characteristics that make SCHD so attractive to dividend investors.

1-How SCHD Selects Dividend Stocks

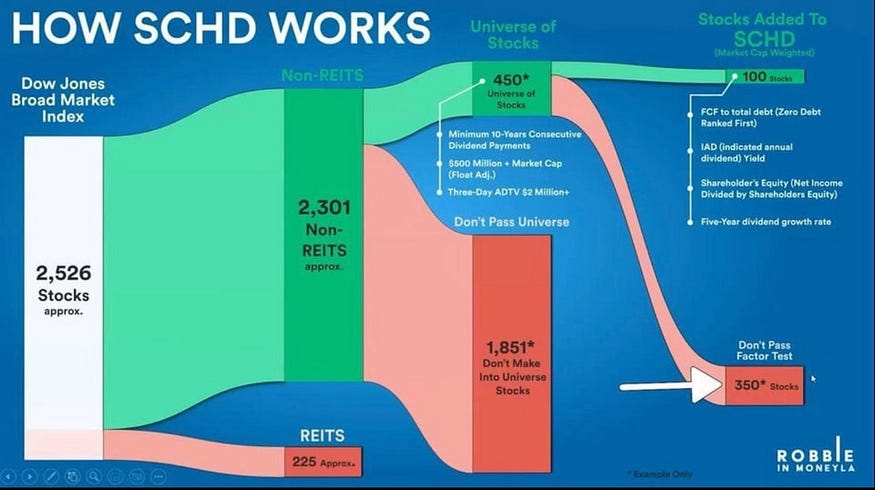

SCHD has some strict requirements for stocks to be in it’s portfolio. The first requirement is that the company is in the Dow Jones broad market index and has had to have been paying a dividend for at least 10 consecutive years. It then checks free cash flow to total debt, shareholders equity, and the five year dividend growth rate to determine which stocks make it into the portfolio. This means they search through 2,526 individual stocks and end up only choosing around 100 of those stocks to put into the portfolio. Below is a visual representation of the process.

For those wondering about what happens to a stock that falls beneath SCHD’s thresholds, the fund employs a strategic rebalancing process once a year. This ensures the portfolio maintains its target goals across its diverse holdings.

2-SCHD’s Share Growth and Dividend Growth

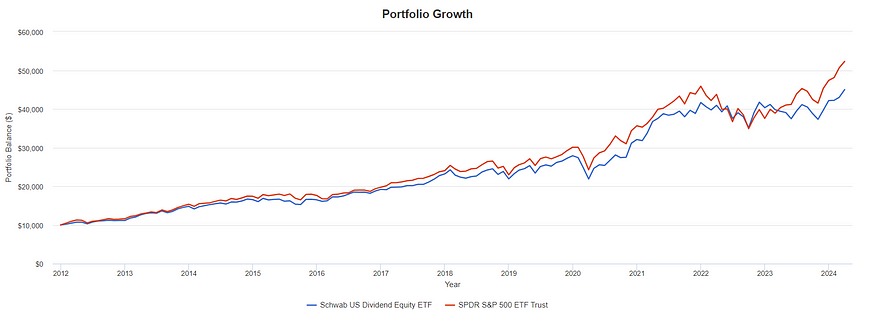

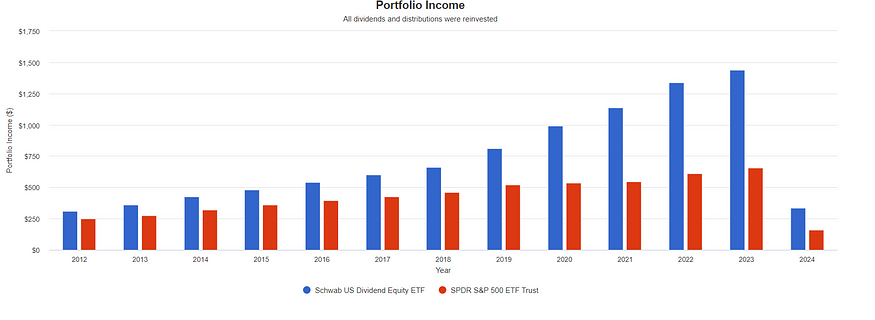

SCHD was created in 2011 and since then has performed incredibly well growing at a 13.06% CAGR ( compound annual growth rate). While most dividend focused ETFs are able to provide a bigger dividend then the S&P most are not able to growth their share price nearly as well as the S&P has. This is where SCHD shines. I used a portfolio visualizer to show what would have happened if you would have put 10,000$ into SCHD and 10,000$ into the S&P in 2011. with SCHD you would now have $44,994 and with S&P you would now have $52,285.

While it has slightly underperformed the S&P it has been growing its dividend at a very rapid pace. The shares of the S&P now would have paid you $655 in 2023 while SCHD would have paid you a whopping $1,439. SCHD has grown it’s dividend per share from $0.1217 in 2011 to $2.6580 in 2023.

Dividend investors are pleased that SCHD has been increasing its dividend at a faster rate than the S&P. This is because SCHD has been able to generate a higher dividend yield than the S&P while maintaining a lower volatility. In the S&P’s worst year since 2011, it decreased by -18.17%, while in SCHD’s worst year, it decreased by only -5.56%.

3- Diversity

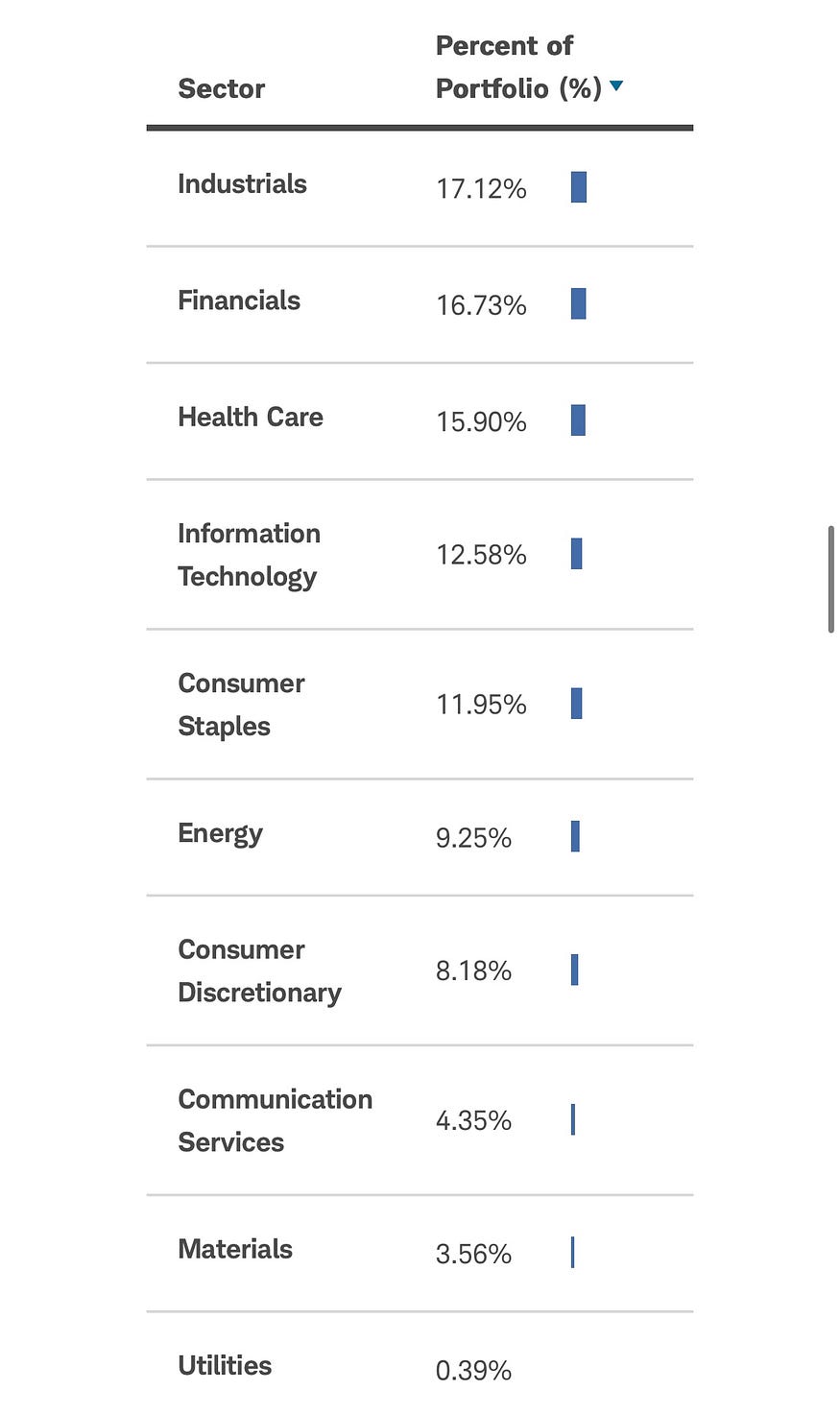

SCHD currently has 102 different holdings in its portfolio which is also split into 10 different sectors.

By investing in SCHD, investors gain exposure to a basket of 102 large-cap U.S. companies, reducing their portfolio’s risk compared to holding individual stocks. This diversification helps lower the impact of any single company’s performance on your overall portfolio. It also reduces an investors risk of picking the wrong dividend stock.

Imagine an investor chooses to not invest in SCHD but invest in PepsiCo a company which SCHD has in its portfolio. Now imagine PepsiCo has a price decline for whatever reason. If PepsiCo’s stock price were to decline, an investor who only held PepsiCo shares would experience a potentially significant loss compared to their investment in the company. In contrast, an investor holding SCHD would likely experience a much smaller impact. This is because SCHD’s holdings are diversified across tons of companies, and PepsiCo’s decline would be offset, to some extent, by the performance of the other companies in SCHD. While a single company’s decline can impact an individual stock holding, its effect on a diversified portfolio like SCHD is lowered, showing the risk-mitigating benefit of diversification.

In conclusion, SCHD is a great choice for the average dividend investor. SCHD selects stocks with a history of strong financials and dividend payouts, and it prioritizes companies with sustainable dividend growth. While its overall return may currently be slightly lower than the S&P 500, SCHD compensates with a faster growing dividend.

Comments

Post a Comment